Cast your mind back to the pandemic. Primark’s revenue had stalled due to its reliance on stores. Pundits were quick to point out the perils of brick-and-mortar without an e-commerce presence.

Many retailers were quick and proudly introduced their e-commerce offerings, direct-to-consumer and on marketplaces.

They bet big, sparred on by the exponential rise in e-commerce during that period.

Many predicted the train would not slow down, and we would become couch potatoes and digital zombies post-pandemic.

In addition, many new online-only brands hit the scene to capitalise on this growing trend.

Primark was the exception to the rule

But let me point out one firm stood still.

And that, of course, is Primark as they resisted the temptation to dive into e-commerce and D2C.

Yes, they enhanced their digital experience by introducing a new website. But in the main, that website existed to form a closer link to their stores.

They wanted people to go into their shops and use the site as a window into their world rather than a final destination.

Given what they have just been through in the pandemic, this approach certainly got much attention and even criticism. However, they did not knee-jerk into e-commerce and now see the fruits of their foresight.

Let’s dig into the detail to reveal why this is the case.

A perfect storm for e-commerce

There is an almost perfect storm brewing for e-commerce retailers.

Firstly, in 2022 came an end to “growth at all costs”; with it, the VC funding model evaporated from under their e-commerce and digital retailers’ feet.

Examples include Wayfair and Allbirds, which have lost over 65% of their market capitalisation during this period.

Secondly, consumers were hit with rising costs and with economic headwinds afoot meant, they were spending less.

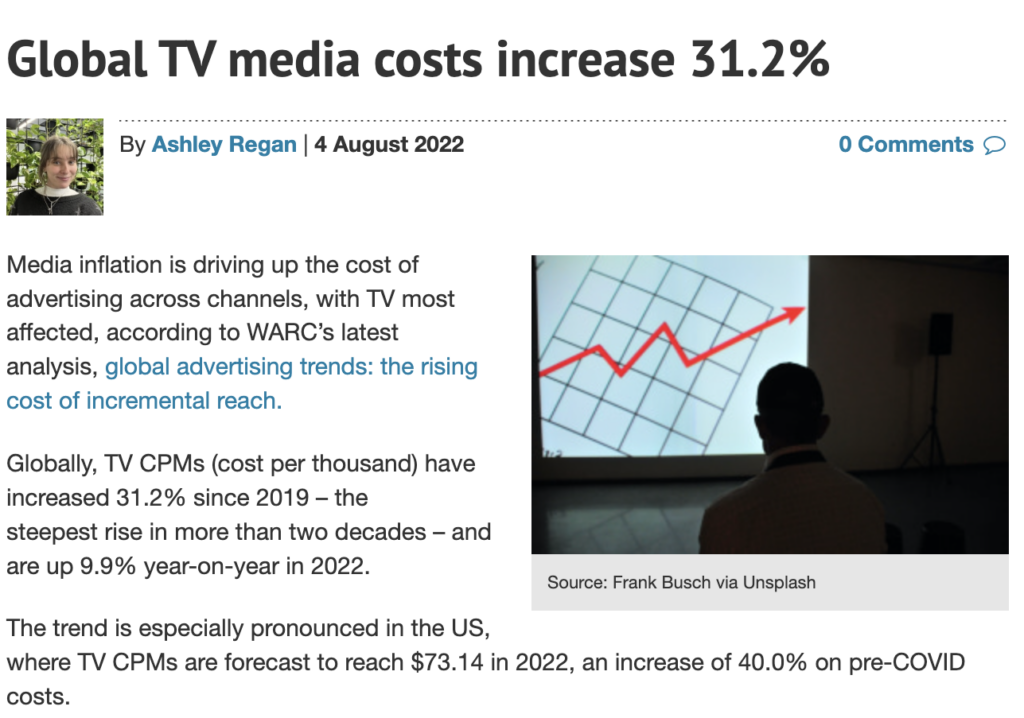

Thirdly, the cost of digital media to spread the word and keep these retailers front of mind was hit by massive inflation.

Some channels reported as high as 31% inflation.

Fourthly, the consumer trend buying behaviour towards online shopping at best resumed to pre-pandemic levels and not the predicted exponential growth, which made the juice not worth the squeeze for retailers who had invested heavily in fixed assets to service a new lower level of demand.

And finally, all the logistics disruption at the hands of European geopolitics and Brexit meant that transportation costs had spiralled.

Impact on e-commerce led brands

In the era of “growth of all costs”, there was a pure signal from the market; focus on top-line growth and worry about bottom-line change later.

1. Focus on top line growth

This meant that the critical trackable metrics to consider were customer acquisition costs and, secondly, customer repeat purchases. In a bid to drive customer acquisition and, rightly so, repeat purchases, e-commerce companies focussed on marketing and advertising.

2. Media inflation

This came crashing down with media-led inflation and fewer consumers willing to make frequent purchases. They needed to continue to discount heavily to move inventory, which we know from Les Binet’s analysis is not wise. So their funnels become far more expensive, and fewer customers go through them; a double whammy.

3. Logistics and servicing costs

However, the full blow is yet to be delivered. You see, these companies should have fully appreciated that profitability is often won by the operations and logistics department over marketing. Your cost to service, deploy, deliver and deal with inventory and customers most efficiently creates a substantial competitive advantage.

The key metric here is the cost of fulfilment, and here is where the tides are firmly against e-commerce. In the Gravity of E-commerce report by Castlin and Hankins, which appears in WARC, they discussed the difference in the marginal cost of fulfilment between retail and e-commerce.

4. A one-to-many model

In retail, there is a many-to-one model for satisfaction. You fill up big trucks and ship all the goods to one location. Doing so allows you to take advantage of economies of scale across your distribution model.

On the other hand, when it comes to e-commerce, they describe a one-to-many model, in which each suitable needs to be shipped to an individual. A cost bared mainly by the brand.

5. Costs of returns

To make matters worse, when you add high return rates again at the brand’s expense, you see how final mile fulfilment makes the difference between being profitable and not. In 2021, online returns were expected to cost retailers $218 billion, which is 20% of all goods sold. The return cost is driven by several factors, including shipping costs, labor costs, and restocking fees. In addition, returns can also damage a retailer’s relationship with its suppliers.

It is, therefore, unsurprising that the same report shows that when looking at the bottom line, e-commerce players are twice as likely to be unprofitable than bricks and mortar companies. Doing e-commerce work is so much more complicated than people think.

Examples; Amazon and Nike Direct

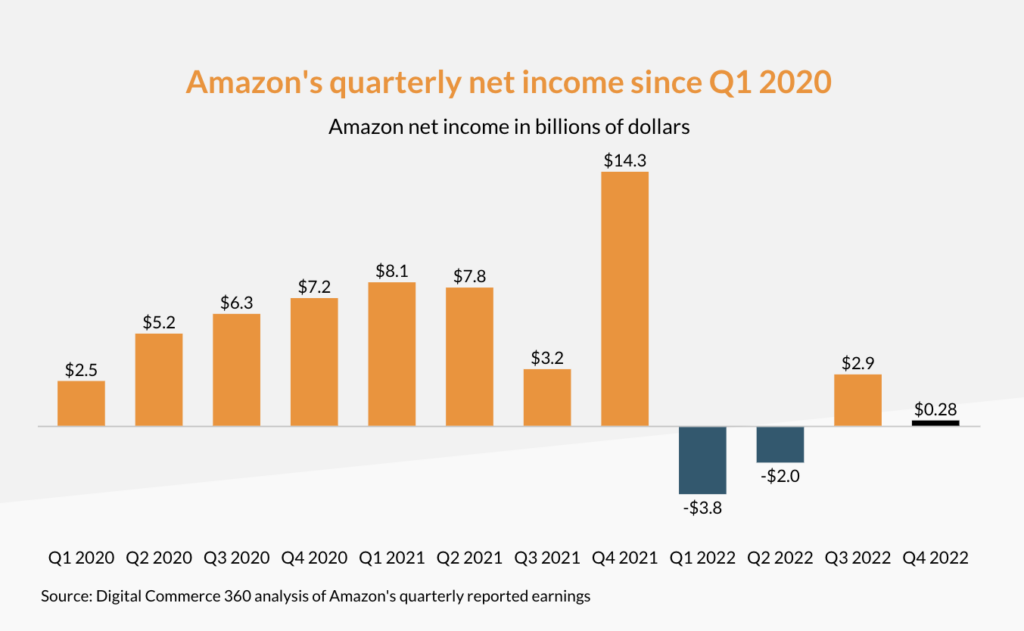

Let’s look at two further examples here. The first is Amazon, hailed as the poster child for e-commerce. Well, their net income suffered tremendously in 2022. Check out the diagram for more information.

Let’s look at two further examples here.

The first is Amazon, hailed as the poster child for e-commerce.

Well, their net income suffered tremendously in 2022.

Check out the diagram for more information.

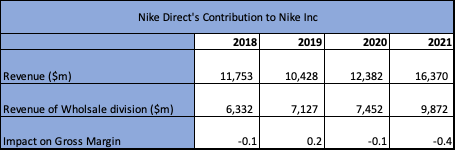

Secondly, another a-class retailer, Nike Direct.

Look at their financial figures, which show that even they struggle to make e-commerce profitable.

Despite direct sales contributing 66% of revenue compared to wholesale, their Direct division in four out of the last five years has been in a net loss regarding gross margin contribution.

And only positively contributed to profitability when e-commerce sales went down tremendously.

It shows that even industry titans need help to sustain e-commerce, given the headwinds against e-commerce and D2C.

Primark dodges a bullet

Under these conditions, Primark did well by not rushing into e-commerce. However, the merits of their physical stores are plenty. From owning the customer experience, lower marginal costs of fulfilment, no delivery fees, lower return rates, and fewer partner costs or commissions by being on a marketplace like Amazon.

This is not to be mistaken for their foray into creating a more compelling digital experience and journey for the customer, except for the lack of an e-commerce presence. Instead, they have a precise click-and-collect service.

The results speak for themselves, which consistently high performance of Primark, where in 2022, they were back at pre-pandemic revenues, with no need for an e-commerce element.

Click and collect; a better model?

It makes me beg the question; is the future of retail click-and-collect rather than e-commerce?

Since you can create a compelling digital journey and get customers to make purchases and collect them from a nearby store, this surpasses the ‘one to many models’ of fulfilment that have plagued many e-commerce retailers.

It also ensures that returns are back in the store, which is far more cost-effective.

More retailers will follow the Primark model in the coming years to get the right balance of online and offline to drive profitability.